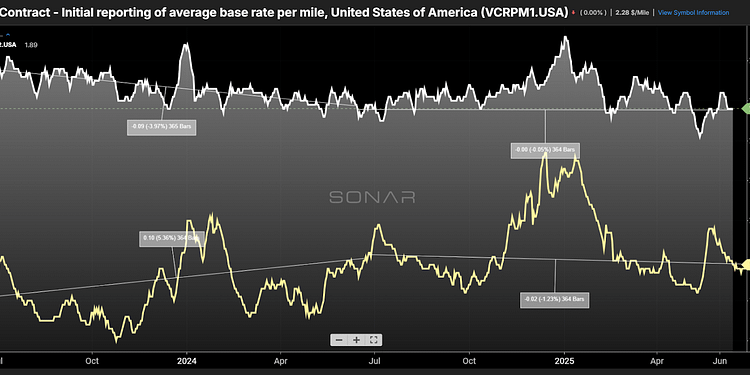

Chart of the Week: Van Contract initial report of average base rate per mile, National Truckload Index (less estimated fuel costs above $1.20/gal) – USA SONAR: VCRPM1.USA, NTIL12.USA

Contract rates for dry van truckload shipments (VCRPM1) are nearly unchanged from this point in 2024, despite the disruptive forces that rocked supply chains earlier this year. Spot rates (NTIL12), which appeared to be accelerating their rise at the end of 2024, are ending the first half of 2025 slightly below year-ago levels. Both rate indices suggest a trucking market that has stalled in its recovery. What are the takeaways from the first half, and what should we watch for in transportation markets over the next six months?

Freight recession gets an extension

After what looked like a straightforward path toward a much stronger freight market in 2025, transportation service providers are closing out the first half of the year in no better position than they were 12 months ago. While the trade war has played a role, it is not the sole driver of stagnation.

Intermodal began reclaiming market share from truckload, which it had lost during the pandemic, early last summer. Long-haul truckload demand (LOTVI) has collapsed—down 25% year-over-year—as shippers have increasingly opted for slower but cheaper transcontinental shipping. Intermodal capacity has expanded significantly since 2020, and it is far easier to add containers into service. This dynamic is arguably the most significant and unforeseen development in the recent multi-year surface transportation downcycle.

Shippers have also extended their order lead times to account for the unstable maritime sector, as attacks on vessels in the Red Sea have made ocean shipping less reliable. These longer lead times have given shippers more flexibility to move goods once they arrive in the U.S.

Warehousing capacity has tightened and costs have risen as a result of this pull-forward strategy. In this environment, intermodal’s slower transit becomes an advantage, effectively serving as rolling storage. Trucking has increasingly become a short-haul delivery mechanism—the only option for that final leg of freight movement.

Erratic trade policy messaging and implementation have further prolonged and exacerbated these trends, keeping truckload demand depressed and surface transportation rates subdued.

Economic stagnation

So far, we’ve focused on the direct impacts of geopolitical tensions and trade policy on supply chains. But at the end of the American economy is the consumer. Companies can stockpile all the goods they want, but if no one is buying them, it doesn’t matter.

The housing market has remained muted. This segment drives a significant share of consumption—not only through construction but also indirectly as people move and purchase furniture and appliances.

Relatively high interest rates and sluggish hiring are largely to blame. Thirty-year mortgage rates were near 3% just a few years ago but have hovered just below 7% in recent months. While a 7% mortgage is not historically high, it is substantially higher than what many homeowners locked in previously, discouraging moves. Housing prices have also not been immune to the historic inflation of recent years, compounding the impact of rising rates.

The job market is weakening, though not at a historic pace. Jobless claims have edged higher since January, and companies have slowed hiring. While the unemployment rate hasn’t moved significantly, the deterioration trend is well established.

Most economic headlines have centered on the collapse in consumer and business confidence indices. The University of Michigan’s Index of Consumer Sentiment fell from 74 in December to 60.7 in June, up slightly from May’s low of 52.2.

Sentiment indices don’t always track directly with activity, but when consumers and businesses feel uncertain, they tend to pull back, slowing the economy—and freight volumes—further.

What’s next?

It is nearly impossible to predict what will happen with policy or geopolitical developments. But a few things are certain. The most important factor for transportation service providers is that capacity continues to exit the market, and new barriers to entry are emerging.

While demand erosion has delayed a significant rebound in trucking, it hasn’t changed the fact that capacity is steadily shrinking. Intermodal will continue to keep overall rates in check as long as urgency remains low.

The transportation market has always needed a catalyst to flip, and these catalysts are often unpredictable. Still, the likelihood of a sharp shift continues to rise. While some dismiss this narrative as tired, the underlying math hasn’t changed.

If any economic clarity emerges or a stimulating event occurs in the second half of 2025, the shift could be sudden and significant. After more than three years of unwinding excess capacity, the market is increasingly vulnerable. Language requirement enforcement and increased vetting from government agencies will at bare minimum make it harder to get a CDL. Net revocations of trucking operating authorities are still averaging well above last year’s levels, signaling that conditions remain unfavorable but are inching closer to an inflection point.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new datasets each week and enhancing the client experience.

To request a SONAR demo, click here.

The post Trucking market stalls in first half of 2025, despite tumultuous trade environment appeared first on FreightWaves.