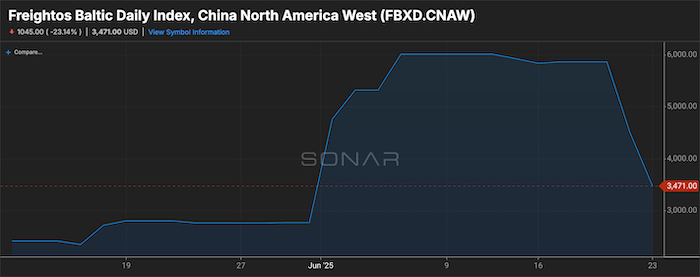

Last week, global energy markets and container shipping faced turmoil due to escalating missile exchanges between Israel and Iran, alongside worries about Iran’s potential retaliation for U.S. bombings and the threat of closing the Strait of Hormuz. These developments had significant consequences for oil prices and logistics. However, a tentative ceasefire between the U.S. and Iran has provided some respite, potentially preventing major disruptions. Despite the ongoing conflict, tanker operations through the Strait of Hormuz and activities at Dubai’s Jebel Ali Port, the busiest in the Persian Gulf, continued largely as normal, as did operations at Israeli ports. Iranian missile strikes did result in several Israeli casualties in at least one instance. As the immediate crisis in the Middle East appears to be calming, focus is now shifting back to the U.S. trade war and the imminent expiration of tariffs. Countries besides China that are impacted by U.S. reciprocal tariffs must finalize their agreements by July 9, or risk facing higher duties. However, progress in talks with key trading partners such as the European Union, Canada, and Vietnam has been slow, although a preliminary deal has been made with the United Kingdom. President Donald Trump has shown openness to imposing tariffs on his own if agreements are not reached, even as some officials in his administration propose extending negotiations for those demonstrating genuine effort. In the context of the U.S. trade situation, it was expected that an agreement would be reached to uphold a 30% baseline on imports from China, but specific information has been limited. Nonetheless, the initial spike in demand that occurred after the May 12 halt on tariffs, prior to the August 12 deadline for lower U.S. tariffs, seems to be diminishing. Since March, carriers have boosted trans-Pacific capacity by 43% and are now experiencing a significant drop in container spot rates, especially for the West Coast. Following the tariff pause on May 12, container rates for eastbound trans-Pacific shipments have fallen from their peak levels. (Graph: SONAR). According to SONAR’s Freightos Baltic Index, the prices for shipments from Shanghai to Long Beach have returned to levels seen in late May, around $3,700 per forty-foot equivalent unit (FEU). Meanwhile, rates for the East Coast have decreased from $7,200 to $6,300 per FEU. In contrast, Asia-Europe shipping rates increased by 6% last week, reaching $3,100 per FEU, while prices for shipments to the Asia-Mediterranean region dropped by 9% to $4,400.